T. Rowe Price Capital Appreciation PRWCX vs TCAF

I was asked recently what I thought of T. Rowe Price Wanted Appreciation (PRWCX) compared to T. Rowe Price Wanted Appreciation Probity ETF (TCAF), which has gained $235 million in resources under management since its June 2023 launch. TCAF is one of two new T Rowe Price offerings that play off the unparalleled success of the PRWCX, which is sealed to new investors. The other new entrant, the T. Rowe Price Wanted Appreciation and Income Fund, has not yet debuted.

The most striking similarities are the name and the fact that they are both managed by David R. Giroux, who has an outstanding record. From here, the similarity fades. PRWCX is a moderate to growth-oriented mixed-asset fund, while TCAF is a predominantly domestic probity fund. There are differences in how the probity sleeve of PRWCX compares to TCAF, which are explored in this article.

Let’s start with a review of PRWCX surpassing diving into the infant TCAF.

BEST MIXED-ASSET TARGET ALLOCATION GROWTH FUNDS

source: google.com

T Rowe Price Wanted Appreciation (PRWCX) is classified by Lipper in the Mixed-Asset “Growth” Category and Morningstar as a “Moderate” category. Its current typecasting is well-nigh 62% equities, but the fund has a lot of flexibility to retread to market conditions.

The list of best-performing mixed-asset target typecasting growth funds over the past ten years is small. To select the five funds in Table #1, I used the Top Quintile of the MFO Rating for 3, 5, and 10 years for funds misogynist at Fidelity. Dodge & Cox Balanced (DODBX) has a transaction fee, and PRWCX has been sealed to new investors since 2014.

T Rowe Price Wanted Appreciation (PRWCX) is the standout performer. It is the category’s only Great Owl, which ways it is the only growth typecasting fund to generate unceasingly top-tier risk-adjusted returns over all trailing periods. To be clear, it is The One out of 250 such funds. It has been in existence for 37 years and has been managed by David R. Giroux for the past eighteen years. As a result of its performance, it has grown to $53 billion in resources under management. For the past ten years, Allspring Diversified Wanted Builder (EKBAX) has had similar upper overall performance but with increasingly risk. I like that PRWCX has a stock typecasting of 62%, which is moderate compared to EKBAX, with 84%.

Table #1: Best Performing Mixed-Asset Growth Funds – Ten Years

Source: Created by the Author Using the MFO Premium Multi-search Tool

Figure #1: Best Performing Mixed-Asset Growth Funds

Source: Created by the Author Using the MFO Premium Multi-search Tool

My colleague David Snowball offered a complementary wringer of the fund in his August 2023 article on the impending launch of T. Rowe Price Wanted Appreciation and Income. His take: “You superintendency [about the new fund] considering T. Rowe Price Wanted Appreciation is (a) utterly unmatched and (b) sealed tight.”

T. ROWE PRICE CAPITAL APPRECIATION (PRWCX)

The strategy of the T. Rowe Price Wanted Appreciation Fund (PRWCX) is

The fund normally invests at least 50% of its total resources in stocks and the remaining resources are often invested in corporate and government debt (including mortgage- and asset-backed securities), convertible securities, and wall loans (which represent an interest in amounts owed by a borrower to a syndicate of lenders) in keeping with the fund’s objective. The fund may moreover invest up to 25% of its total resources in foreign securities.

The fund’s investments in stocks often fall into one of two categories: the larger category comprises long-term cadre holdings whose prices when purchased are considered low in terms of visitor assets, earnings, or other factors; the smaller category comprises opportunistic investments whose prices we expect to rise in the short term but not necessarily over the long term. There are no limits on the market capitalization of the issuers of the stocks in which the fund invests. Since we struggle to prevent losses as well as unzip gains, we typically use a value tideway in selecting investments. Our in-house research team seeks to identify companies that seem undervalued by various measures, such as price/book value, and may be temporarily out of favor but have good prospects for wanted appreciation. We may establish relatively large positions in companies we find particularly attractive.

We work as nonflexible to reduce risk as to maximize gains and may seek to realize gains rather than lose them in market declines. In addition, we search for lulu risk/reward values among all types of securities. The portion of the fund’s investment in a particular type of security, such as worldwide stocks, results largely from case-by-case investment decisions, and the size of the fund’s mazuma reserves may reflect the portfolio manager’s worthiness to find companies that meet valuation criteria rather than his market outlook.

The fund may purchase bonds, convertible securities, and wall loans for their income or other features or to proceeds spare exposure to a company. Maturity and quality are not necessarily major considerations and there are no limits on the maturities or credit ratings of the debt instruments in which the fund invests. The fund may invest up to 30% of its total resources in unelevated investment-grade corporate immuration (also known as “junk bonds”) and other debt instruments that are rated unelevated investment grade…

PRWCX probity is currently 95% domestic. It is overweight Technology and Healthcare. Thirty percent of its stock-still income is in Wall Loans.

Morningstar gives PRWCX a Five Star Rating with a Gold Reviewer Rating. The Portfolio Manager is David R. Giroux (CFA), and Ira Carnahan (CFA) is a Portfolio Specialist working on the Wanted Appreciation Fund.

According to Morningstar:

David Giroux rose to the management ranks on this strategy in mid-2006 without joining T. Rowe Price in 1998 as an reviewer tent the industrials sector. Initially a comanager, he quickly took a lead role on the portfolio by early 2007 and became the sole manager in June of that year…

Giroux delivers a high-conviction basket of roughly 40-50 stocks that range between 56% and 72% of the fund’s assets. He’ll shift the exposures meaningfully when he identifies mispricing, like scaling probity exposure when drawdowns bring valuations to a increasingly lulu level.

From T. Rowe Price:

David Giroux is a portfolio manager for the Wanted Appreciation Strategy, including the Wanted Appreciation Fund and Wanted Appreciation Probity ETF, at T. Rowe Price Investment Management. He moreover is throne of Investment Strategy and senior investment officer for T. Rowe Price Investment Management. David is the president, chairman, and a member of the Wanted Appreciation Investment Advisory Committee and a member of the Wanted Appreciation Probity ETF Investment Advisory Committee. He is a member of the T. Rowe Price Investment Management ESG Committee and the T. Rowe Price Investment Management Investment Steering Committee.

The Fact Sheet for PRWCX is misogynist here, and the Prospectus is here.

T. ROWE PRICE CAPITAL APPRECIATION EQUITY ETF (TCAF)

T. Rowe Price Wanted Appreciation Probity ETF (TCAF) has an inception stage of June 2023; Morningstar does not requite it a Star Rating but gives it an Reviewer Rating of Gold. It has attracted $235 million in resources to date. Like PRWCX, TCAF is overweight in Technology and Healthcare.

The Fact Sheet for TCAF is misogynist here, and the Prospectus is here. The Principal Investment Strategies of TFAC differ somewhat from PRWXC:

The fund normally invests at least 80% of its net resources (including any borrowings for investment purposes) in probity securities. The fund takes a cadre tideway to stock selection, which ways both growth and value styles of investing are utilized. The fund may purchase the stocks of companies of any size, but typically focuses on large U.S. companies. The portfolio is typically synthetic in a “bottom up” manner, an tideway that focuses increasingly on evaluations of individual stocks than on wringer of overall economic trends and market cycles.

In selecting stocks, the tipster typically seeks out companies with one or increasingly of the pursuit characteristics:

- experienced and capable management;

- strong risk-adjusted return potential;

- leading or improving market position or proprietary advantages; and/or

- attractive valuation relative to a company’s peers or its own historical norm.

The fund seeks to maintain approximately 100 securities in the portfolio.

Sector allocations are largely the result of the fund’s focus on stock selection. The fund may at times, invest significantly in unrepealable sectors, including the information technology and healthcare sectors.

The fund is “nondiversified,” meaning it may invest a greater portion of its resources in a single issuer and own increasingly of the issuer’s voting securities than is permissible for a “diversified” fund.

This Morningstar video, 3 New ETFs That Stand Out From the Pack, describes how TFAC differs from the probity portion of PRWCX, including longer holding periods and lower dividend yields to enhance tax efficiency. In addition, TFAC will hold own approximately one hundred stocks that the Team believes will unhook higher risk-adjusted returns.

Figure #2: Comparison Selected Urgently Managed Large Cap Cadre ETFs – Two Months

Source: Created by the Author Using the MFO Premium Multi-search Tool

The histogram in Figure #3 shows the performance of all urgently managed probity ETFs with at least $100 million in resources under management. TCAF resides in the largest bin with two month returns of 1.65% to 2.0%.

Figure #3: Histogram of Urgently Managed Large Cap Cadre ETFs

Source: Created by the Author Using the MFO Premium Multi-search Tool

Closing Thoughts

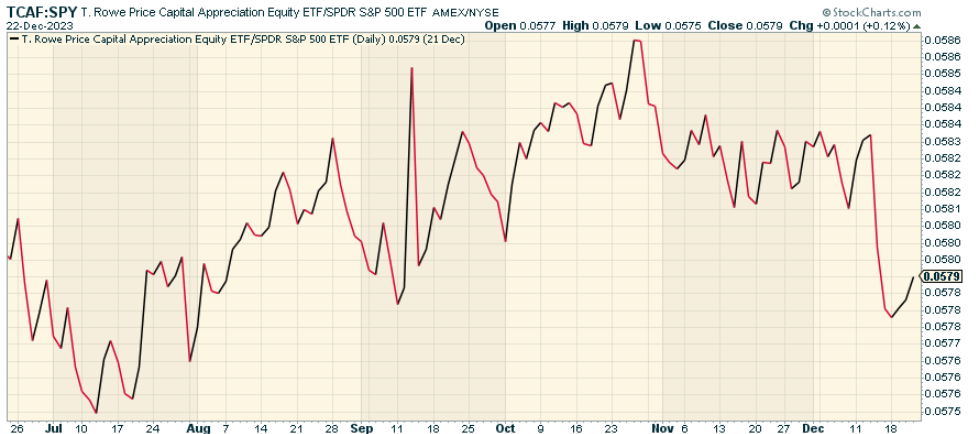

With the combination of economic slowdown, upper stock-still income yields, strikes by the United Auto Workers, government shutdown, and seasonal fluctuations, I protract to be conservative. I have dry powder for opportunities that may arise. I like urgently managed ETFs. Unelevated are the five that I track plus S&P 500 (SPY) and PRWCX over the past two months, which are too short to get meaningful performance comparisons but may reflect relative volatility.

Figure #4: Author’s Short List of Urgently Managed Probity ETFs (Plus SPY & PRWCX)

Source: Created by the Author Using the MFO Premium Multi-search Tool

I wrote One of a Kind: American Century Avantis All Probity Markets ETF (AVGE) and Fidelity Urgently Managed New Millennium ETF (FMIL) describing why I like these funds. I own a small starter position in AVGE. As a result of writing this article, I am moreover interested in ownership TCAF during dips.